We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Checkmark Expert verified

Bankrate logoHow is this page expert verified?

At Bankrate, we take the accuracy of our content seriously.

“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

Written by

Matthew Goldberg

Matthew Goldberg is a consumer banking reporter at Bankrate where he uses his more than 13 years of financial services experience to help inform readers about their important personal finance decisions.

Edited by

Brian Beers

Brian Beers is the managing editor for the Wealth team at Bankrate. He oversees editorial coverage of banking, investing, the economy and all things money.

Reviewed by

Kenneth Chavis IV

Kenneth Chavis IV is a senior wealth counselor at Versant Capital Management who provides investment management, complex wealth strategy, financial planning and tax advice to business owners, executives, medical doctors, and more.

Bankrate logoAt Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Bankrate logoFounded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Bankrate logoBankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Here is a list of our banking partners.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

Bankrate logoYou have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Money orders allow you to securely send or receive payments, providing an alternative to cash, checks or credit cards. They are similar to checks, but, because they’re prepaid, money orders can’t bounce.

They can, however, get canceled or refunded if not filled out correctly. It’s important to know what information you’ll need to fill one out and where that information goes.

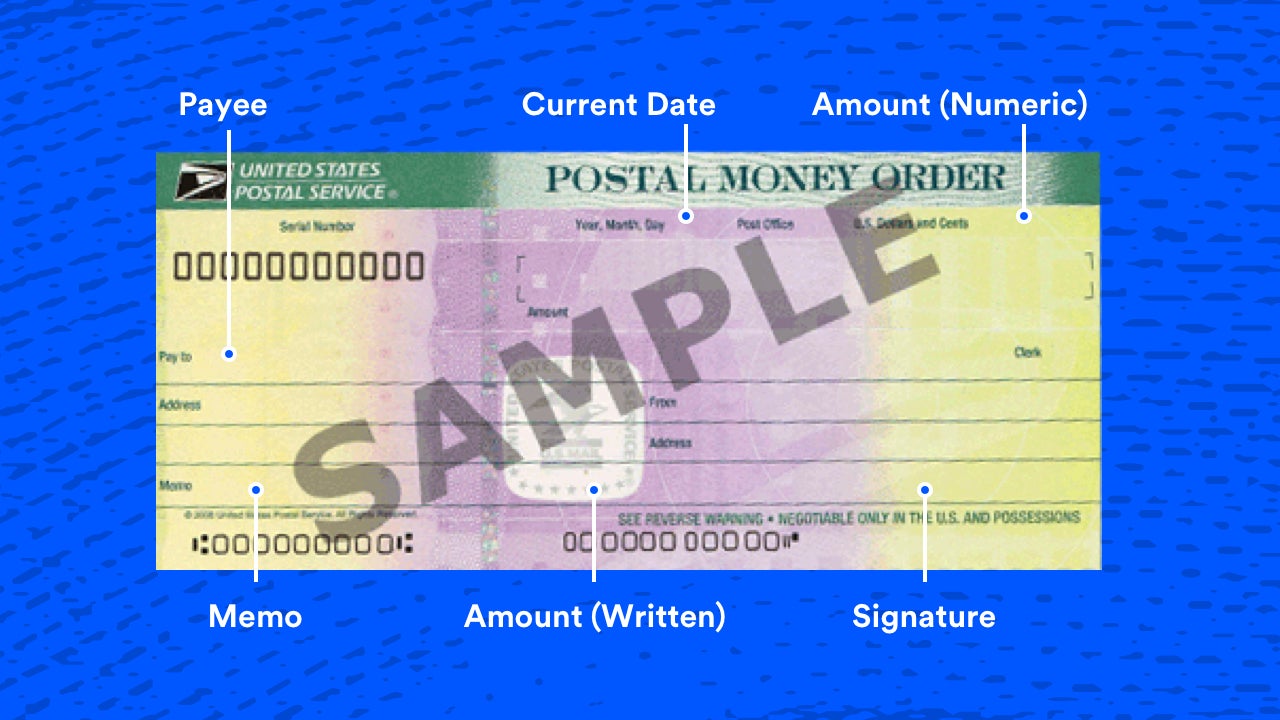

The requirements to fill out a money order vary by institution, whether its Western Union or the U.S. Postal Service (USPS). Each institution’s money order may differ slightly in appearance as well. Generally, the information you’ll need to fill out a money order is:

You’ll also need a form of payment to purchase the money order. Some issuers limit your payment options, too. You likely won’t be able to purchase a money order with a credit card.

Write the name of the payee of the money order in the “pay to” or “pay to the order of” field. This could be a person’s name or the name of a business. Print the name clearly in ink.

It’s important to fill out this section as soon as you purchase the money order, since this will be the only person authorized to cash or deposit it. If the money order is lost or misplaced without a payee’s name written down, it could be liable to fraud and someone else could write their name on it.

If given the option, fill out your name in the field labeled “from,” “purchaser” or “sender.”

Fill in your address where the money order asks for the purchaser’s address. There may be a second address field for filling in the address of the payee. If so, you’ll want to fill that out as well.

A memo line allows you to note what the money order is designated for. The memo might specify that it’s a purchase for a particular item or a payment toward a debt, for example. If you have an account or order number from the payee, the memo field is also where to include that. Some money orders may say “payment for” or “account number” instead of memo.

Sign the front of the money order where indicated. This section may be labeled Purchaser’s signature, Purchaser, From, Signer or Drawer. Don’t sign the back of the money order, which is where the payee endorses it.

Be sure to keep the receipt because it contains a tracking number, which can be used to find out whether the right person cashed the money order. In case the money order is lost or stolen, the tracking number can help you replace it. A processing fee may apply for replacing a money order.

The receipt can also help you cancel the money order should your plans change.

If while filling out the “Pay to” portion of the money order causes it to be “spoiled,” then you can have it replaced, according to the USPS.

You might be able to write “not used for purpose intended” on the back of your money order and cash it. Check with your bank and the money order issuer for their policies on this.

At Western Union, you can’t change the payee’s name on the money order but you can submit a refund request through Western Union, according to its website.

Money orders can be purchased with cash or a debit card at banks and credit unions, check-cashing businesses, the U.S. Postal Service, many grocery stores and some big-box stores.

Avoid using a credit card to purchase a money order, since your credit card company may consider the purchase a cash advance and charge steep fees. Some issuers won’t accept credit cards as payment, either.

There may be limits on the size of the money order you can purchase. The Postal Service, for example, allows you to buy money orders up to $1,000 if you’re sending it within the U.S. On top of the price of the money order, a $1–$10 fee typically applies.

Money orders can be a useful alternative to checks or cash for paying bills, paying off debt or making large purchases, especially for those who don’t have a checking account.

They’re a safe paper option for those who want to avoid a payment bouncing — they can’t be declined for insufficient funds, since they are prepaid. Money orders also don’t require the purchaser to have a bank account since they can be purchased without one, such as with cash.

Additionally, money orders are a good alternative to electronic payments when you prefer or are required to send money through the mail. They don’t contain bank account information, so it won’t end up in the wrong hands. Plus, as with a check, only the recipient can cash the money order.

Money orders are a safe and reliable option for sending and receiving payments. They can be purchased with cash or a debit card and offer a secure alternative to checks or cash. It is essential to fill out all necessary fields accurately and legibly to avoid any potential issues or fraud.

Money orders are a valuable tool for those without a checking account or for sending money through the mail without sharing sensitive bank account information. Consider using a money order for your next payment and enjoy the peace of mind that comes with this secure method.

– Freelance writer Mitch Strohm contributed to a previous version of this article.

Arrow Right Senior Consumer Banking Reporter

Matthew Goldberg is a consumer banking reporter at Bankrate where he uses his more than 13 years of financial services experience to help inform readers about their important personal finance decisions.