Discover how establishing a cost-effective family bank can secure wealth for generations through strategic management and cohesive family governance.

✅ Establishing a family bank can safeguard wealth across generations

✅ Family banks are not only for the ultra-rich – all you need is a Limited

✅ Clear goals, diversified investments, and family involvement are crucial

✅ Regular review and adapt strategies to ensure resilience and longevity

In today’s complex financial landscape, preserving and growing wealth across generations is a challenging task.

Despite the clear benefits, only a tiny fraction of families, I’d guess less than 0.1%, take the crucial step of setting up family holding companies, which I will refer to as “family banks.”

Such entities are pretty easy to set up and offer a structured approach to managing family assets, ensuring financial stability, and fostering unity among family members.

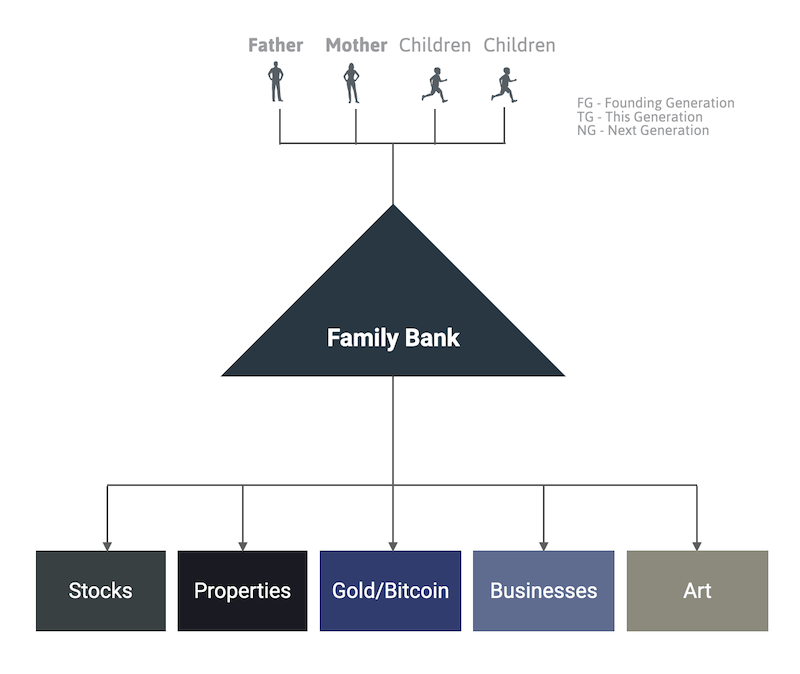

A family bank, also known as a family holding company or family trust, is a structured entity designed to manage and preserve a family’s wealth across multiple generations.

Unlike a traditional bank, a family bank is privately owned and operated by the family itself, often encompassing a range of financial assets, including investments, real estate, and businesses.

By establishing a family bank, families can gain a series of benefits.

Introducing a family bank can revolutionize how wealth is managed and preserved across generations.

Beyond conventional financial planning, these entities offer distinct advantages that empower families to safeguard their assets and foster enduring prosperity.

Family Unity: Promotes collaboration through shared financial goals, open communication, and decision-making

Asset Protection: Centralizing assets within a family bank shields wealth from potential creditors and legal liabilities

Tax Efficiency: Strategic financial planning within a family bank minimizes tax burdens on inherited assets and income

Succession Planning: Shares can be transferred in a tax-optimized manner, ensuring smooth transitions across generations

Financial Education: Provides a platform for educating younger generations about family values and responsibility

Flexibility: Options are endless, e.g. the current can give a loan to the next generation to buy shares in the family bank

By leveraging these benefits, families can establish a robust foundation for long-term financial security and intergenerational prosperity, maintaining their legacy for years.

The concept of a family bank often conjures images of extreme wealth and dynastic families.

However, they offer a structured approach to managing wealth that can benefit families of varying financial backgrounds and sizes.

Let’s dispel the most common myths:

Accessible Structure: Family banks can have simple structures and legal forms, such as a Limited or Inc. with two shareholders

Financial Planning: They provide the family with more financial tools for effective financial planning, regardless of the wealth

Asset Consolidation: Even modest assets can benefit from consolidation within a family bank, offering protection and strategic management.

Setting up a family holding company is surprisingly straightforward:

After reading multiple books on this subject, you hear about a certain set of challenges:

Let’s now take a look at some interesting families in some select countries:

| 🇺🇸 U.S. | 🇬🇧 U.K. | 🇩🇪 Germany | 🇫🇷 France | 🇮🇹 Italy |

| Walton – Walmart | Rothschild | Quandt – BMW | Arnault – LVMH | Medici |

| Busch – Anheuser | Cavendish | Haniel* – Cewe / Takkt | Dassault | Colonna* |

| Du Pont | Grosvenor | Albrecht – Aldi | Hermes | Borghese |

| Bechtel | Barclay | Reimann – Reckitt | Bettencourt L’Oreal | Agnelli |

| Ford | Guinness | Porsche – VW | Schlumberger | Orsini |

The Colonna family of Italy is interesting. According to Jim Rickard’s excellent book, The Road To Ruin, for over 900 years, the Colonna family has maintained their wealth through strategic holdings, including

centered around their historic residence, The Palazzo Colonna in Rome.

The Haniel family in Germany stands out for its long-standing presence and influence in industrial sectors, particularly through the Haniel Group, which has diversified investments ranging from chemicals to consumer goods.

Known for their prudent management across generations, they have adapted to economic shifts while maintaining a focus on sustainability and innovation, solidifying their legacy as a stalwart of German business and industry.

What makes them unique

| 🇪🇸 Spain | 🇦🇹 Austria | 🇸🇪 Sweden | 🇵🇹 Portugal | 🇳🇱Netherlands |

| Ortega | Mateschitz – Red Bull | Wallenberg | Espírito Santo | Brenninkmeijer |

| Botín | Leitner – Andritz | Kammerlander | Amaral | Heineken |

| Isidoro Alvarez | Graf – Novomatic | Persson | Mello | Van der Vorm |

| March | Swarovski | Klingenberg | Soares dos Santos | Van Oranje-Nassau |

| Puig | Mayr-Melnhof | Ek | Queiroz Pereira | Van Loon |

1/ Keep It Simple: Don’t overcomplicate things. Have a simple family holding Limited or Inc, with the current generation as shareholders.

2/ Define Clear Goals and Governance: Establish a simple family constitution outlining shared values, goals, and governance structures to guide decision-making and ensure continuity across generations.

3/ Diversify Asset Holdings: Spread investments across various asset classes such as stocks, real estate, private equity, maybe bonds, Gold and Bitcoin, to mitigate risks and optimize returns over the long term.

4/ Educate and Involve Family Members: Foster financial literacy and engage family members in financial discussions and decisions to ensure informed participation and unity.

5/ Seek Professional Guidance: Consult with financial advisors, estate planners, and legal experts to navigate complex tax laws, succession planning, and asset protection strategies effectively, safeguarding the family’s wealth for future generations.

By following these 5 best tips and regularly updating your strategy, you are laying a strong foundation for future generations through your family bank.

With proactive management and a commitment to preserving your legacy, your family bank can thrive and endure for many generations to come.